Mecklenburg County Appraisal District

County Assessor’s Office Assessor's Office

The annual tax listing all delinquent taxpayers for that year, published annually pursuant to NCGS 105-369. County Assessor's Office Provides property valuation and resources for all taxable property in Mecklenburg County, NC. The Mecklenburg County Assessor’s Office is responsible for the discovery, listing and assessment of all County real and personal property.

https://cao.mecknc.gov/

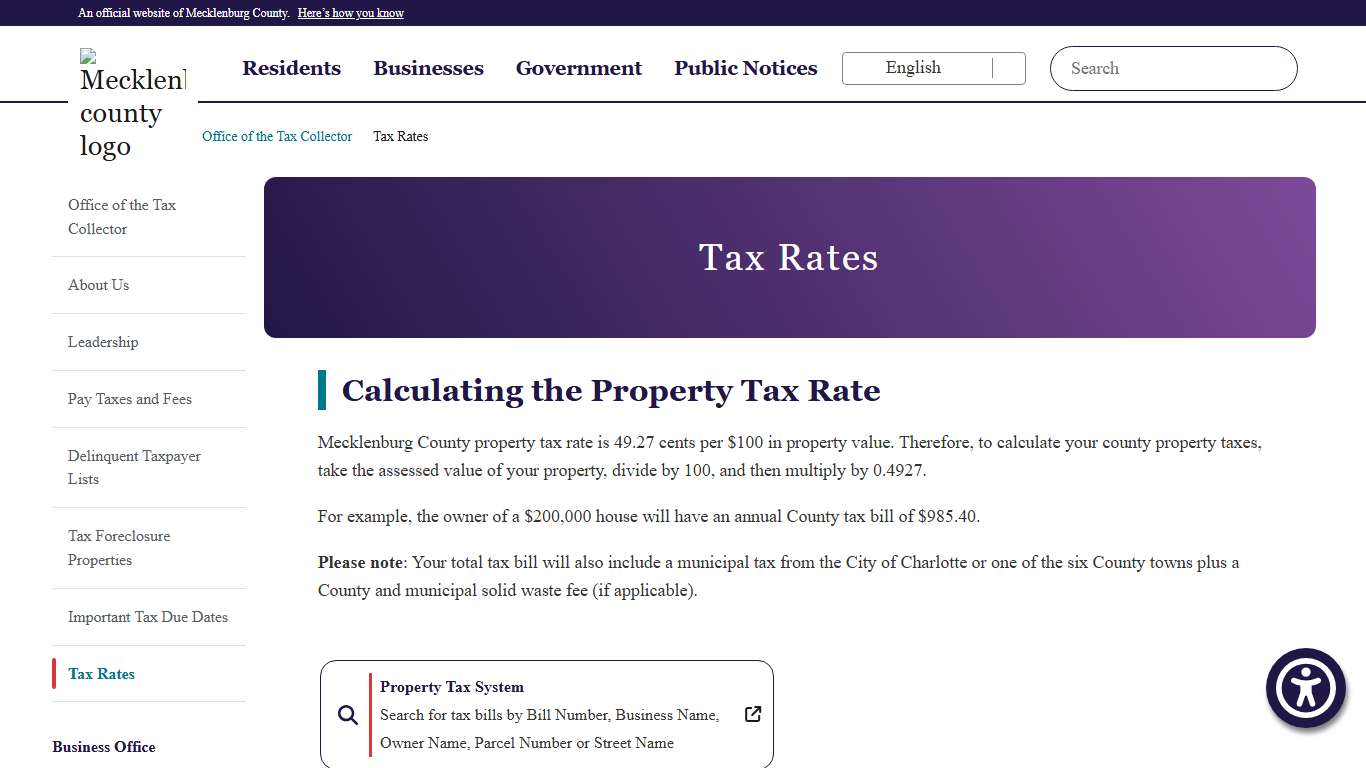

Tax Rates Office of the Tax Collector

Tax Rates Calculating the Property Tax Rate Mecklenburg County property tax rate is 49.27 cents per $100 in property value. Therefore, to calculate your county property taxes, take the assessed value of your property, divide by 100, and then multiply by 0.4927.

https://tax.mecknc.gov/tax-rates

County Property Tax Rates and Reappraisal Schedules NCDOR

The Raleigh Service Center has moved to its new location on Highwoods Blvd following regular business hours. Review the Raleigh Service Center's new address and business hours. A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-rates/county-property-tax-rates-and-reappraisal-schedules

Property Value Appeals Assessor's Office

Property Value Appeals The appeal process is an essential component of property valuation. Property owners are entitled to request that values of their properties be reviewed (appealed) with consideration to aspects of the property that may not have been included when the value was determined.

https://cao.mecknc.gov/appeals

Property taxes going up in Mecklenburg County for 2025-26

Some — including Mecklenburg County — increased their property tax ... Mecklenburg will dip deeper into reserves to fund 3 nonprofits in 2026 ...

https://www.charlotteobserver.com/news/politics-government/article308306010.htmlMecklenburg County Revaluation Davidson, NC - Official Website

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled “Explore your accessibility options”.

https://www.townofdavidson.org/1121/Property-Revaluation2025 Property Tax Payment Instructions for Mortgages and Mass Payments Office of the Tax Collector

2025 Property Tax Payment Instructions for Mortgages and Mass Payments This memorandum provides needed information by institutions and mortgage lenders submitting tax payments. The process and schedule for property tax payments is detailed below. The Mecklenburg County Office of the Tax Collector (OTC) collects real estate taxes for Mecklenburg County, the City of Charlotte, and the six surrounding towns: Cornelius, Davidson, Huntersville, Mat...

https://tax.mecknc.gov/news/2025-property-tax-payment-instructions-mortgages-and-mass-payments

Real Estate Services - City of Charlotte

Services include property sales, portfolio management and acquisitions...

https://www.charlottenc.gov/City-Government/Departments/General-Services/Real-Estate-Services

Taxes/Assessments - Matthews NC

Property Taxes Mecklenburg County handles all assessment, valuation, billing and collection of property taxes for the Town of Matthews. Property taxes are levied on land, buildings, motor vehicles, boats, trailers, and income-producing personal property. The amount of tax is based on the assessed value of the property and the tax rate.

https://www.matthewsnc.gov/pview.aspx?id=20779&catid=0

You post the video after the deadline and reference use postmark date that’s now outdated? Good job mainstream media 😂...

https://www.instagram.com/reel/DTJECYPj-2S/

You post the video after the deadline and reference use postmark date that’s now outdated? Good job mainstream media 😂...

https://www.instagram.com/reel/DTJECYPj-2S/

Cabarrus County Citizens Against Tax Hikes & For Government Transparency Sitting here eating my dinner and watching local news and this segment comes on Facebook

Sitting here eating my dinner and watching local news and this segment comes on. Our very close neighbor, Mecklenburg County, is going to have another property tax increase. They just had one last year. This is my biggest fear with leadership in our county because it could very well happen in Cabarrus County before 2028. We are facing a budget shortfall as well.

https://www.facebook.com/groups/1065723178027857/posts/1360451378555034/

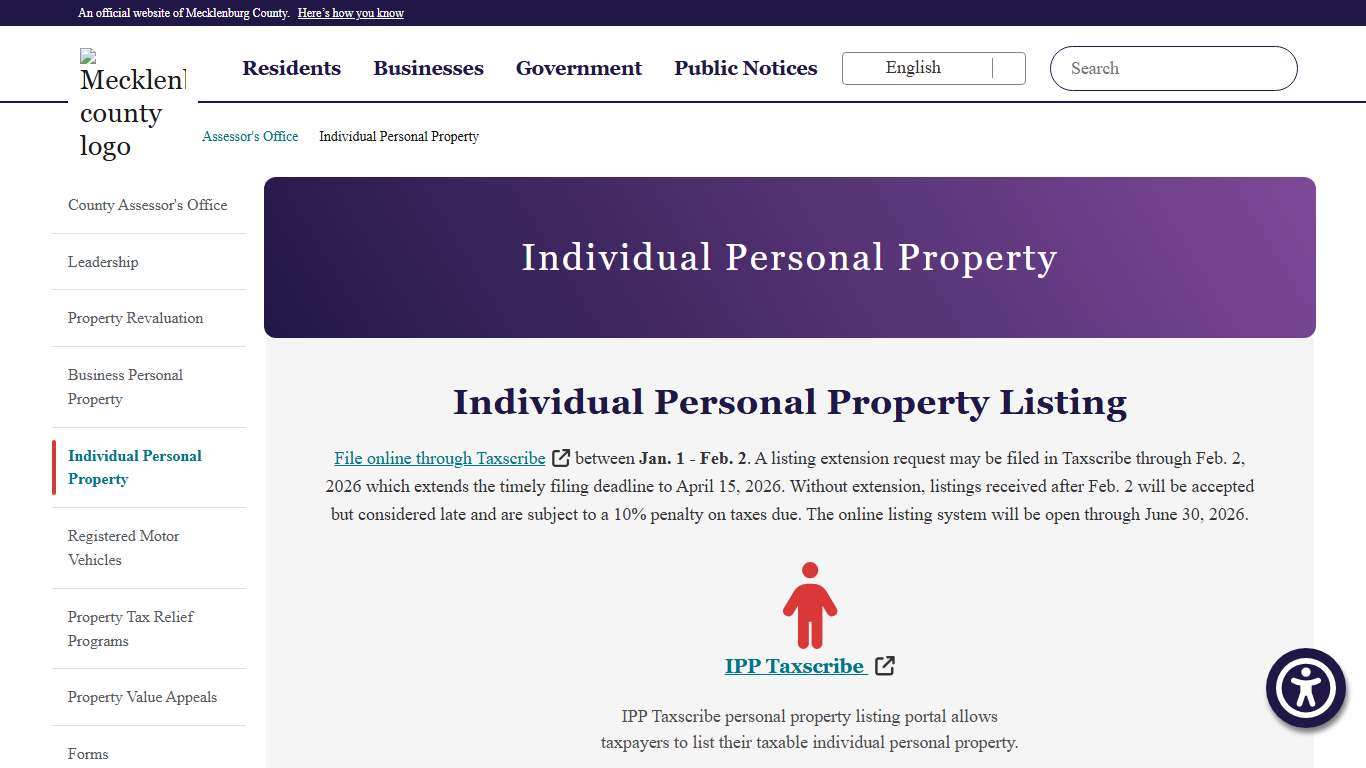

Individual Personal Property Assessor's Office

Individual Personal Property Individual personal property is property owned by an individual or individuals for personal use. If the property is located in Mecklenburg County, or stored or housed at a storage facility, marina or aircraft hangar in Mecklenburg County as of Jan.

https://cao.mecknc.gov/IPP

Mecklenburg County, VA - Official Real Estate Data

THIS SITE IS UPDATED EVERY MONDAY Please contact the assessor’s office at [email protected] or 434-738-6191 ext 4270 for assessment information on parcels showing no value as changes may have occurred. DISCLAIMER OF WARRANTIES ALL FEATURES AND DATA ARE PROVIDED "AS IS" WITH NO WARRANTIES OF ANY KIND.

https://mecklenburg.cama.concisesystems.com/

Higher taxes to come? Ready or not, another revaluation is coming in Mecklenburg County - Axios Charlotte

We use cookies and similar tracking technologies to remember preferences, analyze traffic, and deliver ads. Using some kinds of trackers (like cross-site or behavioral advertising cookies) may be considered a “sale” or “sharing” of personal data under certain state laws. You can opt in or out of these trackers below.

https://www.axios.com/local/charlotte/2022/10/31/what-revaluation-means-for-your-home-and-your-tax-bill-in-mecklenburg-county-311996

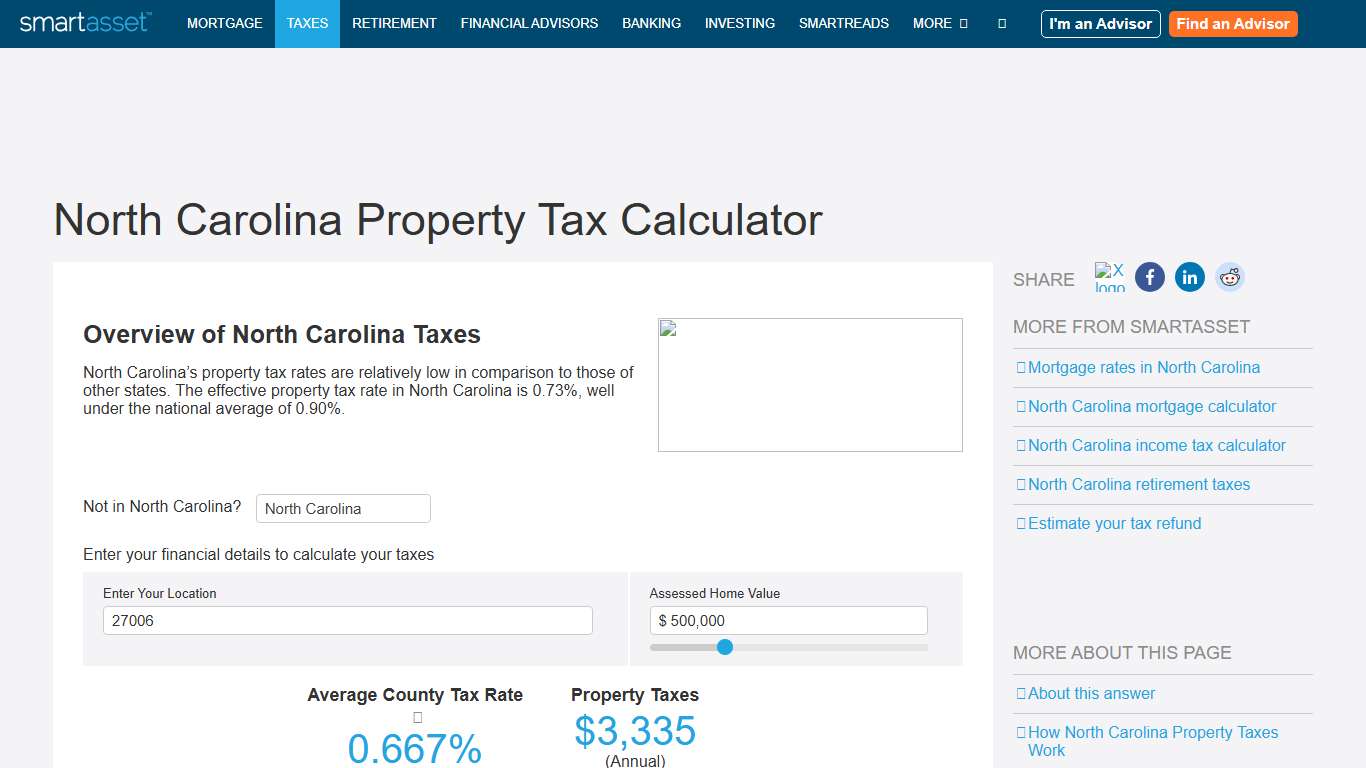

North Carolina Property Tax Calculator - SmartAsset

Overview of North Carolina Taxes North Carolina’s property tax rates are relatively low in comparison to those of other states. The effective property tax rate in North Carolina is 0.73%, well under the national average of 0.90%. - About This Answer To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

https://smartasset.com/taxes/north-carolina-property-tax-calculator